What is Sustainable Investing?

Investing is an integral part of your financial future.

In today’s era, it’s more important than ever to understand the myriad options available to you when choosing where and how your hard-earned money will be invested. As a result, many people are turning towards sustainable investing as a way to make their portfolio greener. But what does this entail? Let’s take a closer look at the basics.

Sustainable investing aims to support businesses that have positive environmental or social impacts on society while minimizing risk for investors over time. The goal is not only profit maximization but also long-term sustainability for both business and society as well! With so many different investment methods out there, how do you know which one is right for you?

I’ve seen a lot of people face this conundrum. Ultimately, the best investment strategy for you is dependent on your goals and risk tolerance. The growing awareness towards sustainable investing has given rise to unique offerings that are not widely understood in the industry, but it’s important to know what they mean – and which one might be right for you!

Sustainable Investing Terms

Here is an overview of some of the key terms:

Green Investments: These investments seek positive environmental or social impacts as an objective of the investment so they have a net benefit for society. Green investing may also include negative screening (avoiding certain stocks such as fossil fuels because they have unfavorable social impacts). The goal is to make money by supporting companies that do more good than harm.

Socially Responsible Investing (SRI): SRI aims to support companies with positive social impacts. However, it does not exclude negative screening which means that you could still invest in fossil fuels if they are profitable! SRI is the most popular method of sustainable investing as it is broad enough to include a wide range of industries and strategies yet flexible enough to be applied to your individual goals.

Environmental, Social and Governance (ESG) Investing: ESG investing achieves both environmental and social objectives without negatively impacting financial returns. These investments tend to have more stringent criteria than other methods such as using only renewable energy or requiring greenhouse gas-neutrality targets for assets under management. As a result, many ESG strategies are full of stocks that are both small and illiquid, making it difficult for investors to gain exposure.

Types of Sustainable Investments

Green Bond Investing: Similar to green investment strategies but targeted at the bond market. This means that you can use these products to diversify across a range of industries without having significant impacts on your portfolio return. These bonds typically pay interest above the average, signaling additional risk for the holder (just like any other investment). The issuer will also place restrictions or limitations upfront in order to mitigate environmental risks over time. However, some issuers can be vague about what this actually entails which could lead to unintended consequences down the road!

Sustainable Exchange Traded Funds (ETFs): An ETF is an investment fund traded on stock exchanges that tracks a certain index. They allow you to invest in the market at a low unit cost and with low operating expenses, making them a great choice for any sustainable investor. Most ETFs track major indices such as the Dow Jones Industrial Average (DJIA) so they offer widespread diversification that is easily accessible to most investors. And some of these funds have incorporated ESG into their model in different ways! Here are three sustainable investing strategies that go beyond traditional SRI:

1) Socially Responsible Index Investing (SRII): This method uses an index fund tracking socially responsible companies rather than specific stocks. The criteria typically consists of positive environmental and social factors – but not necessarily both. As a result, it could exclude fossil fuel companies and still invest in tobacco or alcohol producers.

2) Focused Impact Investing (FII): This method requires a higher level of due diligence by the investor as it are usually only offered to institutions instead of individuals. A key difference from SRII is that each issuer must have an ESG impact target which means you can actually see what they are doing! But as this is difficult work, many investors choose not to do this on their own so they hire experts or boutique investment firms that specialize in FII strategies to handle the investment for them.

3) Cumulative Environmental Social and Corporate Governance (CESCG): This strategy focuses on companies’ sustainability practices through corporate governance, environmental management and social responsibility. For example, this method would exclude companies that are not paying their staff a living wage but still invest in tobacco producers.

What is the Future of Sustainable Investing?

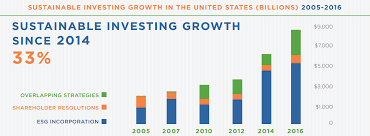

Sustainable investing has been growing over the past decade – and it’s estimated to continue increasing as more investors seek out sustainable options for their portfolio. The number of SRI funds grew from 708 in 2012 to 985 in 2017 across every asset class from stocks to bonds and even real estate! This trend will only continue with projections estimating around 1,100 SRI funds by 2020 and 2,000 funds by 2025. Experts believe that demand for sustainable investment strategies will catch up with supply at some point within the next few years which means we could witness a major shift towards more sustainable options. In fact, the Rockefeller Family recently announced they planned to divest their portfolio completely from fossil fuels but will instead invest in clean energy technologies. And it’s not just big investors that are shifting towards sustainability – 40% of Americans want their money to be invested responsibly and another 35% are willing to pay a premium for sustainable products in order to support these efforts!

Another topic that is gaining traction with investors is impact investing – which has both financial and social outcomes . With all this demand, more companies could start incorporating ESG into their business model through different financing structures like green bonds or working capital loans. For now, it seems as though the future is looking green for sustainable investments!

0 Comment